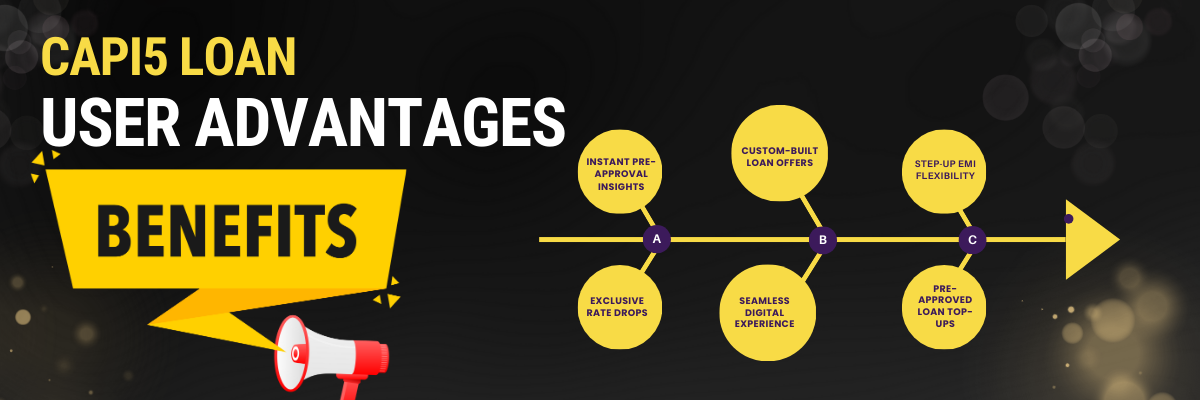

Features & Benefits

Capi5 offers a comprehensive range of loan products with standout features and benefits designed to meet your financial needs. Our loans come with competitive interest rates, ensuring affordability, and flexible repayment options that cater to your specific financial situation. With a fast approval process, you can access funds quickly without unnecessary delays. Minimal documentation simplifies the application process, making it hassle-free. Plus, Capi5 provides a fully digital application experience, allowing you to apply and manage your loan entirely online. Whether you need a personal loan, home loan, or business loan, Capi5 ensures a seamless and transparent borrowing experience, backed by expert support at every step.

Customizable Repayment Options

Choose from a variety of repayment plans, including step-up or step-down EMIs, to match your financial situation and future income expectations.

Enhanced Approval Process

Benefit from a streamlined and transparent approval process that makes securing your home loan faster and easier.

Exclusive Homebuyer Perks

Take advantage of special offers and incentives for first-time homebuyers or those looking to refinance, including reduced processing fees and special interest rates.

Home Equity Utilization

Access the equity in your existing property for additional funding, allowing you to invest in new opportunities or manage personal expenses.