CAPI5

TYPES OF LOANS

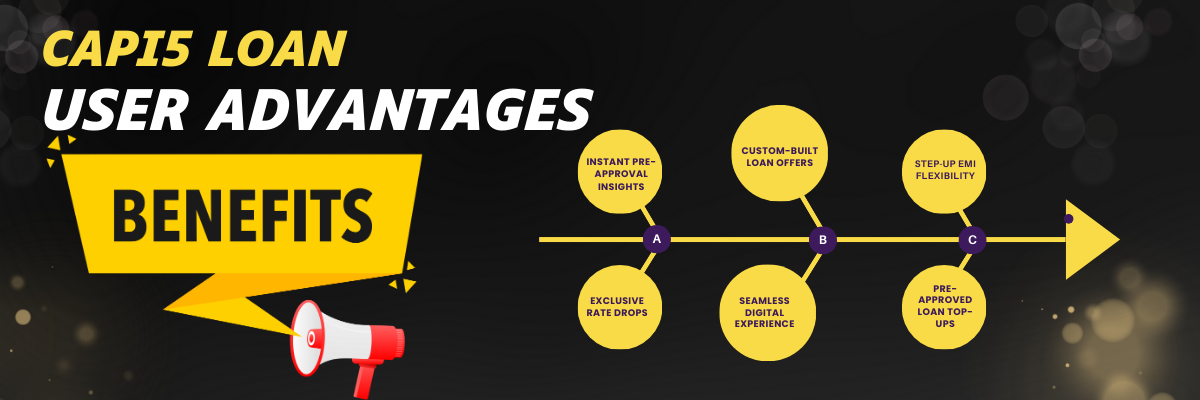

Features & Benefits

Capi5 offers a comprehensive range of loan products with standout features and benefits designed to meet your financial needs. Our loans come with competitive interest rates, ensuring affordability, and flexible repayment options that cater to your specific financial situation. With a fast approval process, you can access funds quickly without unnecessary delays. Minimal documentation simplifies the application process, making it hassle-free. Plus, Capi5 provides a fully digital application experience, allowing you to apply and manage your loan entirely online. Whether you need a personal loan, home loan, or business loan, Capi5 ensures a seamless and transparent borrowing experience, backed by expert support at every step.

Customizable Repayment Options

Choose from a variety of repayment plans, including step-up or step-down EMIs, to match your financial situation and future income expectations.

Enhanced Approval Process

Benefit from a streamlined and transparent approval process that makes securing your home loan faster and easier.

Exclusive Homebuyer Perks

Take advantage of special offers and incentives for first-time homebuyers or those looking to refinance, including reduced processing fees and special interest rates.

Home Equity Utilization

Access the equity in your existing property for additional funding, allowing you to invest in new opportunities or manage personal expenses.

Ask Us Anything

FAQ

Yes, Capi5 provides personalized loan solutions tailored to your unique financial situation, whether it’s for a personal emergency, business expansion, or property acquisition.

Capi5 takes a holistic approach, considering factors such as your income stability, employment history, current financial commitments, and potential for future growth, in addition to your credit score.

Yes, Capi5 offers debt consolidation services that allow you to combine multiple loans or debts into a single, easy-to-manage loan with better terms and interest rates.

Absolutely, Capi5 specializes in offering loans to emerging businesses and startups in niche sectors. Whether you are in tech, retail, or another industry, we offer flexible loan products to support your growth.

Yes, Capi5 offers flexible repayment plans, including step-up and balloon payments, allowing you to adjust your EMI payments based on income fluctuations, especially for self-employed or seasonal income earners.

Capi5 provides exclusive benefits for first-time homebuyers, including lower interest rates, tailored loan terms, and step-by-step guidance throughout the home loan process.

Yes, Capi5 supports green initiatives by offering specialized loans for eco-friendly projects, including renewable energy installations, sustainable home improvements, and green business ventures.

Yes, Capi5 offers credit-building loan products that help you improve your credit score by structuring manageable monthly payments, ensuring timely repayment history, and providing financial guidance.

Loyal customers enjoy exclusive perks such as lower interest rates, higher loan limits, and faster approvals for future loans, as well as access to premium financial advisory services.

Capi5 offers tailored support during financial difficulties, including loan restructuring, EMI deferrals, and reduced penalties during crises, ensuring that you stay on track without undue financial stress.